Intelligence Hub

Real-time business & performance analytics for electronic trading.

Corvil Intelligence Hub is a real-time trade analytics solution that models & correlates client trading behavior, plant performance and venue counterparty execution to enable proactive business management & operations.

Precision Visibility Into the Plant’s Impact on Trading Outcomes

Trace transaction execution through every plant hop, translation, and parent/child relationship

Track open market orders, monitor limits, application risk, and quickly close orders after a component failure

Monitor transaction execution performance & completeness

View how the plant impacts a specific client’s flow and trading outcomes, filtering down to even specific order types

A.l. assisted configuration, providing automatic detection of join keys and rules, for rapid setup and ease of maintenance

Correlate Plant Performance with Trading Outcomes

Pico Intelligence Hub delivers real-time visibility into what’s happening now, derived from the actual trade messages, their measurement through the plant, and execution through counterparties.

It gives both business summarization and granular insight into client/desk trading behavior, and how its impacted by the plant and counterparty performance.

Pico Intelligence Hub is a comprehensive & complete turn-key solution, with value delivery measured in days not months. Providing a single point of visibility to all business and technical stakeholders across the line of business.

Delivery Execution Transparency With Brochure-Quality Reports

Execution reports issued to your clients become an integral part of your product & service, they represent your company and brand.

Integrated reporting allows rich data-driven corporate branded reports to be delivered to internal or external stakeholders, allowing execution performance to be scrutinized in aggregate, or down to individual trades.

Detect problems as they’re happening

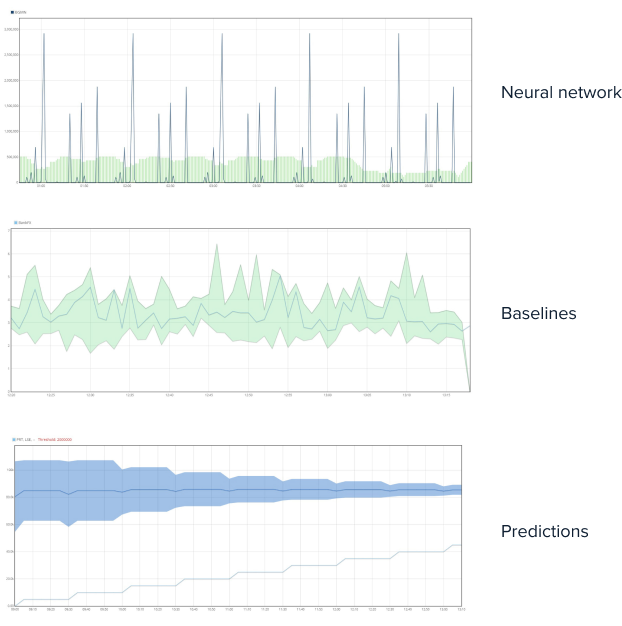

Machine learning warns of changes in client behavior, plant performance, and venue execution problems, as they’re happening, in real-time.

Irrespective of whether you are a business or technical user. its critical to be alerted to abnormal client, plant, and counterparty problems.

Pico Intelligence Hub provide an extensive range of anomaly detection algorithms, so you can be notified of changes in business patterns as they happen.

In additional an alert correlation and consolidation engine turns the alerts generated from the analytics into a manageable and actionable set of notifications.

Detect problems as they’re happening

Pico Intelligence Hub is an open data sandbox. The business intelligence user interface supports interactive ad-hoc queries, as well as an integral SQL Lab for more advanced custom analysis. It also provide two data processing tools for more advanced users.

Ingest-based state processing, where custom configuration can be used to conduct complex trading analysis.

Scheduled SQL, where complex SQL queries can be executed periodically and output custom cubes & tables to deliver fast rendering, historical analysis and analytics.

Business Challenges

Sell Side

The buy-side are increasingly using transaction cost analysis tools and algo wheels to scrutinize their broker trade performance, making data driven decisions when weighing up execution options. The impact for the sell side is increasing flow reallocation and client churn.

Intelligence Hub allows the sell side to measure trade plant performance using the same metrics and criteria that the buy side is making execution routing decisions upon. It provides the sell side with real-time insight into the impact of plant performance and venue execution on their clients trading outcomes. Machine learning and analytics allows the business to move a proactive footing, so service impacting problems and changes in client behaviour can be detected as they happen.

Market Makers

Regulators require exchanges to monitor the volume of unexecuted orders to prevent disorderly trading conditions (e.g. MiFID II RTS-9). Exceeding exchange order-to-trade ratios (OTR) limits can incur fines or suspensions.

Intelligence Hub allows market makers to walk an optimal line between high frequency order replacement to deliver best bid-offer spreads, while being compliant with regulatory requirements which limit the volume of unexecuted orders that can be placed on the exchange by members.

Buy Side

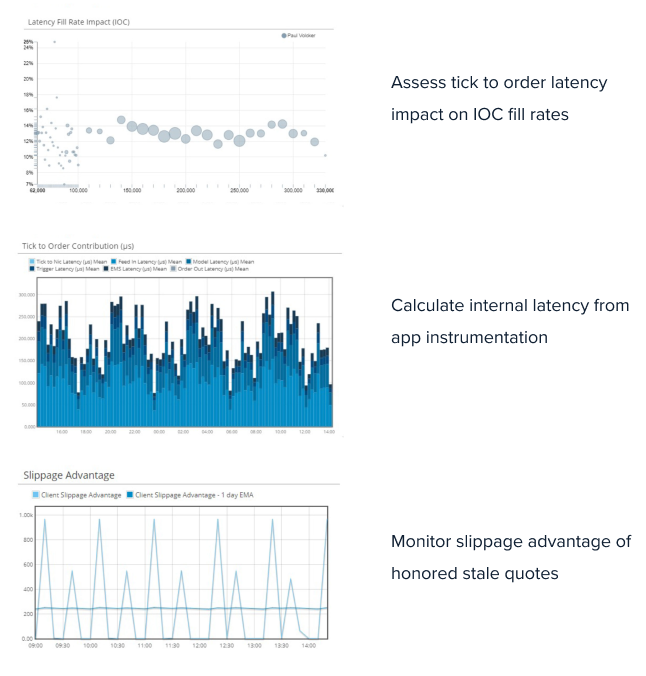

Traditionally the buy side has a had to opt between distinct tools to provide insight on infrastructure performance, service performance, business intelligence and trade execution analytics. The separation of tools makes it difficult to relate market data performance, plant performance, and counterparty execution, directly with trading outcomes.

Intelligence Hub enables proactive operations and business management, without waiting for the trading desk to complain, or worse, lose their edge. Advanced machine learning baselines key execution quality performance metrics like tick-to-order latency, and alerts on anomalies in trading behaviour and execution quality, as it happens, in real-time.

“Corvil helps us navigate OTR requirements with a simplified and consistent process for continuous oversight. Enhanced transparency into desk and trade strategy impacts and predicting conditions, assures us of a leaner, faster and optimized compliance function.”

THOMAS WOLFF

GLOBAL HEAD OF IT, FLOW TRADER