Receiving Historical Data

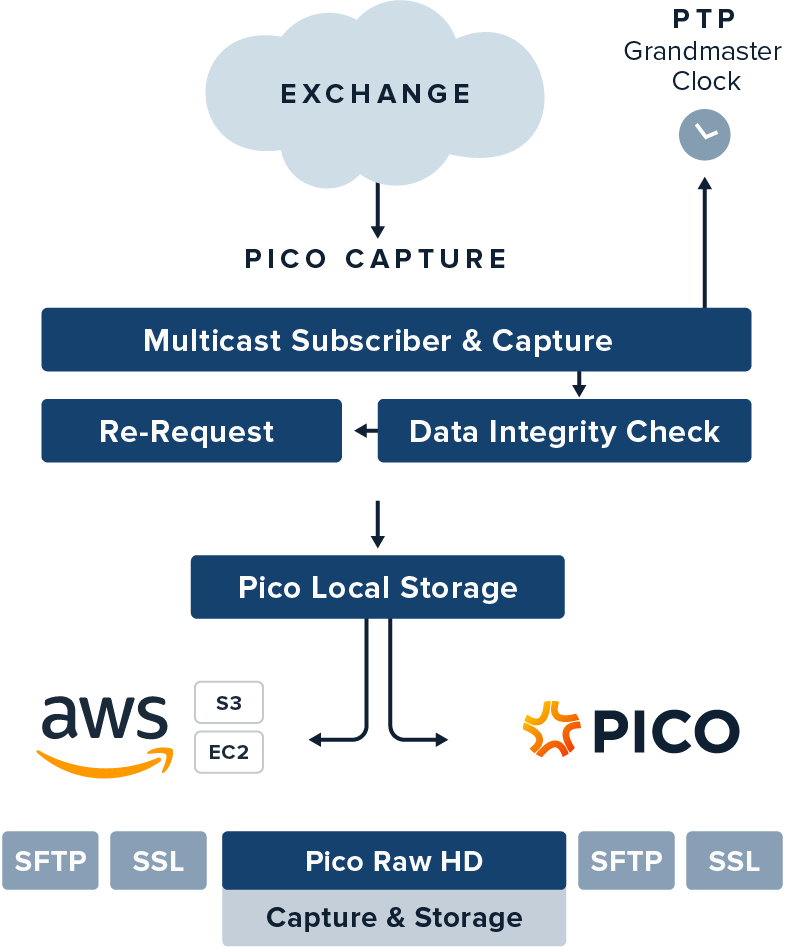

Ongoing subscriptions require an in-region on-prem data center cross connect over PicoNet. Data is made available via SFTP on-demand, intraday, or daily, based on data entitlement restrictions and exchange policies.

One-time deliveries of PRHD are all completed via AWS S3. Pico Implementation engineers will push the history you need from a Pico S3 bucket to your S3 bucket.